Financial acumen training has become a key factor in enhancing employee performance and boosting business skills across organizations. In today’s competitive business environment, companies that provide financial acumen corporate training are empowering their workforce with the knowledge to make informed decisions, improve budgeting, and drive business growth. This blog explores the importance of financial acumen training for employees, how it benefits both individuals and organizations, and why it’s essential for managers to receive specialized financial acumen training.

What is Financial Acumen Training?

Financial acumen refers to the ability to understand and apply financial principles, processes, and strategies to make informed business decisions. Financial acumen training for employees involves teaching them how to interpret financial data, make budgeting decisions, and assess the financial health of an organization. It encompasses topics like profit margins, cash flow, financial statements, and economic indicators, enabling employees at all levels to align their efforts with the company’s financial goals.

Why Financial Acumen Training is Essential for Employees

Whether you work in finance or operations, having a solid understanding of financial concepts is crucial for making effective decisions. Financial acumen training for employees helps them:

- Make more informed decisions by understanding the financial implications of their actions.

- Improve budgeting and cost management by identifying areas to reduce expenses and increase profits.

- Better communicate with finance teams, leading to a more collaborative work environment.

- Enhance problem-solving skills by using financial metrics to identify solutions to business challenges.

Benefits of Financial Acumen Corporate Training

Investing in financial acumen corporate training provides significant benefits for organizations, including:

- Improved Decision-Making: With a deeper understanding of financial concepts, employees are better equipped to make decisions that positively impact the company’s bottom line.

- Increased Efficiency: Employees can identify areas where cost savings can be made, improving overall operational efficiency.

- Alignment with Organizational Goals: Financially savvy employees can better align their actions with the company’s long-term objectives, ensuring consistency and focus.

- Stronger Accountability: Financial training empowers employees to take ownership of their work and understand the financial consequences of their actions.

Discover how our courses can align with your training goals and drive real results.

Learning Built Around Your Goals.

Schedule A DemoWho Should Attend Financial Acumen Training?

Financial acumen training is valuable for employees in any department, not just those in finance or accounting. However, certain groups can benefit particularly from this training:

1. All Employees

Financial acumen training for employees is essential for everyone in an organization. Regardless of the department or job function, understanding the financial impact of business decisions ensures that every individual can contribute to the company’s financial success. Training empowers employees to make smarter decisions, fostering a culture of financial awareness and responsibility across the organization.

2. Managers

Managers play a critical role in driving business success, and financial acumen training for managers is crucial. These leaders are responsible for budgeting, allocating resources, and guiding their teams toward financial objectives. By providing managers with a deeper understanding of financial concepts, organizations enable them to make more strategic decisions, improve profitability, and steer their teams towards achieving financial goals.

How Financial Acumen Training Enhances Leadership Skills

Financial acumen training for managers and leaders helps build stronger, more confident leaders. By equipping them with the knowledge to make financially informed decisions, leaders are better positioned to drive team performance and contribute to the organization’s financial health. Here’s how it helps:

- Informed Decision Making: Leaders who understand the financial impact of their decisions can make choices that positively affect the company’s bottom line.

- Resource Allocation: Financially literate managers can allocate resources more effectively, ensuring projects are adequately funded while maximizing returns.

- Driving Profitability: Managers with strong financial acumen can identify areas for profit optimization and ensure their teams are working towards sustainable financial growth.

- Improved Budgeting: Managers can create more accurate budgets, reducing unnecessary costs and allocating funds where they are most needed.

How to Implement Financial Acumen Training in Your Organization

Implementing financial acumen training for employees can be done through several approaches. Here are some tips for getting started:

- Leverage Online Training Platforms: Many platforms offer courses on financial acumen. These platforms can be used to deliver training to employees in a flexible and accessible manner.

- Incorporate Real-World Scenarios: Use case studies and real-world examples to help employees relate financial concepts to their daily tasks and decisions.

- Focus on Practical Application: Ensure that the training emphasizes how employees can apply their new financial knowledge directly to their roles to drive business results.

- Offer Ongoing Learning Opportunities: Financial acumen is an ongoing learning process. Provide opportunities for employees to continue developing their skills and stay updated on financial trends.

Challenges in Financial Acumen Training

While financial acumen training offers immense value, there are challenges to consider. These include:

- Resistance to Change: Some employees may initially resist financial training, especially if they feel it’s outside of their expertise or role.

- Training Costs: High-quality training programs require investment, and smaller companies may face budget constraints to roll out comprehensive training for all employees.

- Keeping Content Relevant: Financial concepts are constantly evolving, so training programs must be regularly updated to reflect changes in the financial landscape and business practices.

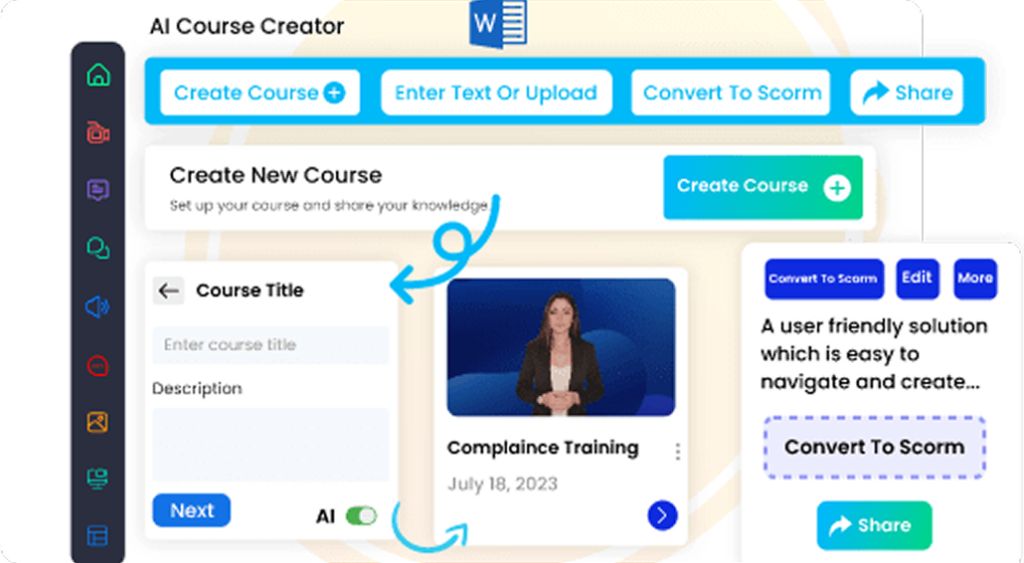

How CogniSpark AI Elevates Financial Acumen Training for Employees

In today’s data-driven workplace, financial literacy is no longer just for the finance team. CogniSpark AI empowers employees at all levels with personalized, easy-to-understand Financial Acumen Training that aligns with real-world business scenarios.

The platform’s AI Tutor adapts lessons in budgeting, forecasting, and profit analysis based on each learner’s role and experience. Whether it’s a manager understanding P&L impact or a non-financial employee interpreting business metrics, CogniSpark ensures content relevance and clarity.

With its in-built authoring tool, L&D teams can update and localize training modules to reflect industry-specific KPIs and company financial goals. The platform is LMS-compatible, making tracking progress, assessments, and knowledge retention seamless across departments.

By integrating interactive case studies, real-time simulations, and automated feedback, CogniSpark AI turns financial acumen from a complex topic into a business-wide strength—fueling smarter decisions, cross-functional alignment, and long-term growth.

Conclusion: Investing in Financial Acumen Training for Long-Term Success

In today’s fast-paced business environment, financial acumen training for employees is no longer a luxury; it’s a necessity. By providing employees at all levels with the knowledge and tools to understand financial data and make informed decisions, organizations can create a more efficient, effective, and profitable workforce. Offering specialized financial acumen corporate training ensures that all employees, from entry-level staff to top executives, are aligned in their approach to driving business growth.

Ready to empower your workforce with the financial knowledge they need to succeed? Start your financial acumen corporate training journey today and watch your business skills and bottom line soar.

Access 100+ fully editable, SCORM-compatible courses featuring an integrated AI Tutor and an in-built authoring tool. Seamlessly compatible with any LMS, these courses are designed to elevate your training programs.

Explore Our eLearning Course Catalog