Description

The AML & KYC Compliance Essentials course is designed to empower learners with the skills to effectively manage anti-money laundering (AML) and know your customer (KYC) compliance tasks. Participants will gain the ability to identify and mitigate financial risks by understanding regulatory frameworks and applying these principles across departments. This course utilizes interactive elements like simulations and case studies to reinforce learning and ensure practical application.

Our curriculum is structured to provide a comprehensive understanding through a four-step learning flow: introduction, deep dive, real-world scenario, and key takeaway summary. This method ensures that learners not only understand compliance theories but also apply them in real-world contexts, enhancing their decision-making skills. The course is fully customizable and scalable, allowing organizations to tailor content to their specific needs.

Participants will benefit from hands-on practice, gaining insights into crafting compliance strategies that are both effective and adaptable. Continuous development options are emphasized, encouraging a culture of ongoing compliance improvement. By integrating these strategies, businesses can expect a significant impact on their compliance processes, leading to reduced risks and improved operational efficiency.

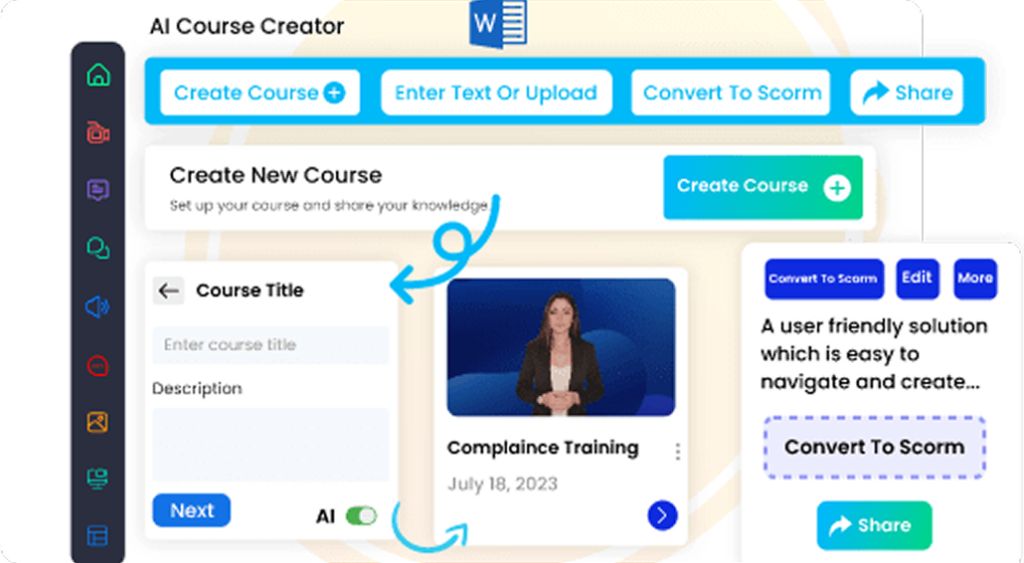

Developed on the CogniSpark AI-powered eLearning authoring tool, this fully editable SCORM course can be seamlessly embedded in any LMS, enabling organizations to efficiently manage and track learning outcomes.

Who Is This Course For?

- Compliance officers seeking an AML & KYC Compliance Essentials course to enhance regulatory knowledge.

- HR professionals looking for an AML & KYC Compliance Essentials training online to integrate into employee development programs.

- Managers aiming to implement AML & KYC training programs for improved risk management.

- Finance professionals interested in AML & KYC online courses to strengthen compliance skills.

Reasons to Choose Our eLearning Course Catalog

Editable & Embeddable SCORM Course

Easily modify the course content and structure to suit your

needs, then embed it directly into any SCORM-compliant LMS

for seamless deployment and tracking.

Fully Customizable with Built-In Authoring Tools

Adapt course content, visuals, and structure to meet your

specific learning objectives with ease.

White Label eLearning Courses

Seamlessly integrate your branding and deliver a consistent

learning experience across your organization.

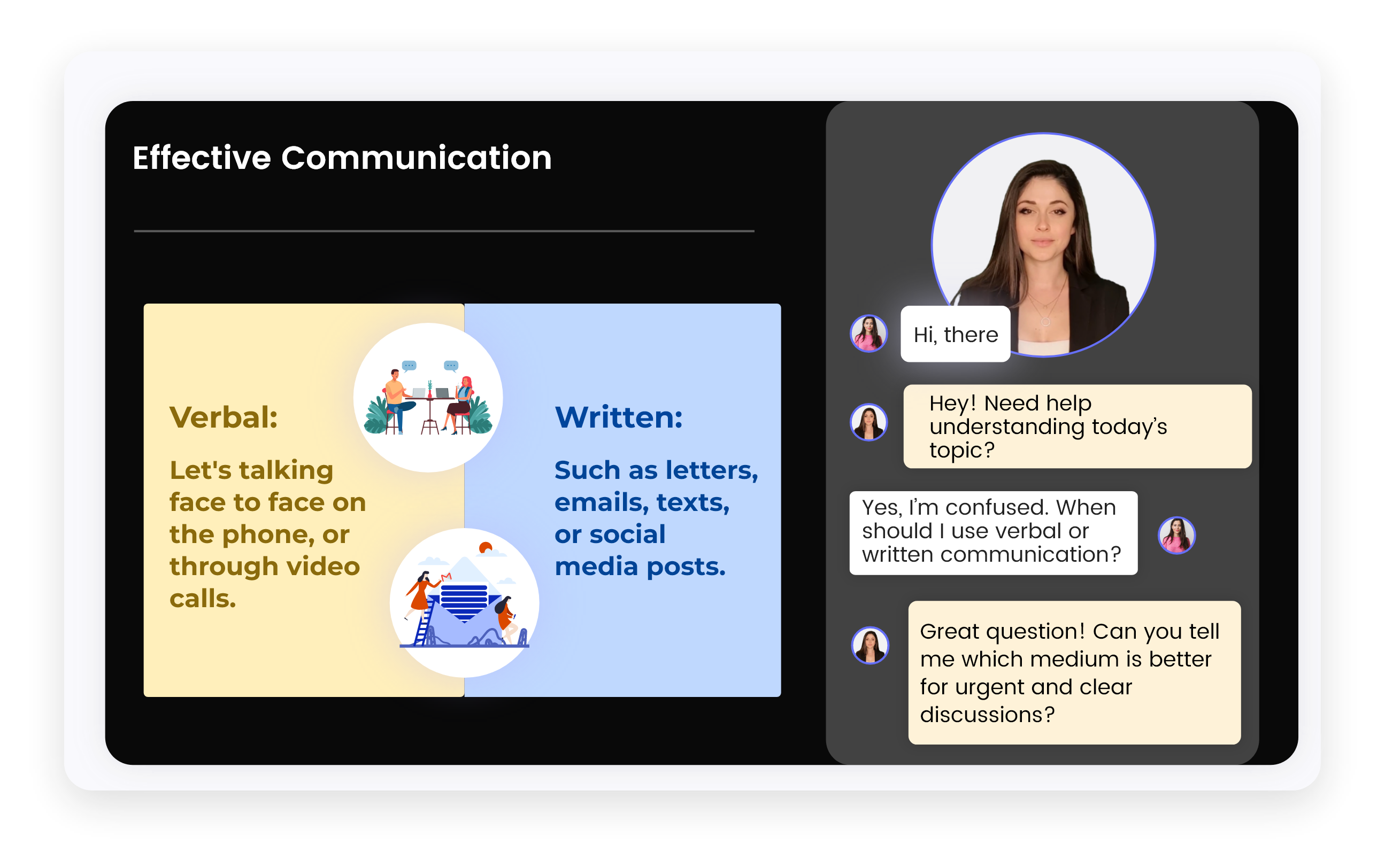

Engaging Content Through Storytelling and Scenarios

Increase retention with real-world communication challenges,

story-driven modules, and practical examples.

Interactive Learning Using Animation and Gamification

Drive learner engagement with visually rich animations, simulations, and game-based learning strategies.

Flexible, Budget-Friendly Pricing Options

Choose a pricing model that fits your organizational needs, whether you’re a startup or a large enterprise.

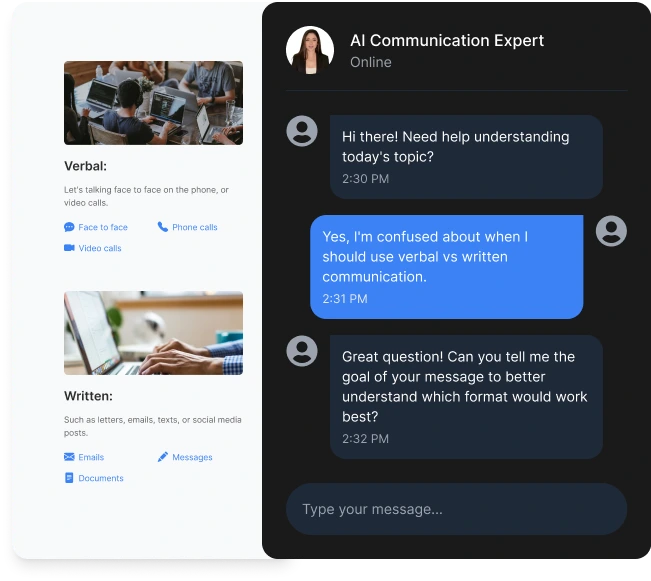

How AI Tutor Helps in eLearning Courses?

Guides learners through the eLearning course

with a personalized, step-by-step learning path.

Explains complex topics in real-time using simple,

easy-to-understand multiple language.

Offers quizzes, helpful hints, and feedback to enhance

understanding and track progress.

Supports voice interaction, allowing learners to speak

instead of type and receive responses in audio format for

a hands-free, engaging experience.

Simulates real-world scenarios through role plays and

interactive simulations to build practical skills and boost

confidence

FAQs (Frequently Asked Questions)

+

The course aims to equip learners with the skills to manage AML & KYC compliance, understand regulatory frameworks, and apply these principles across departments.

+

Our course offers comprehensive content with interactive simulations and case studies, developed on the CogniSpark AI-powered eLearning authoring tool, ensuring top-tier learning.

+

Employees will gain practical skills in compliance, enhance decision-making abilities, and learn to create effective compliance strategies tailored to their organization’s needs.

+

There are no formal prerequisites; however, a basic understanding of financial compliance is beneficial for learners.

+

Yes, the course is fully customizable and scalable, allowing organizations to tailor the content to specific departmental requirements and compliance goals.