Description

The Introduction to Financial Markets and Instruments course equips learners with foundational knowledge and practical skills to excel in today’s financial landscape. Participants will be able to identify various financial markets and instruments, assess their roles, and apply risk management strategies effectively. The curriculum is structured to offer a comprehensive introduction, followed by in-depth exploration and hands-on practice through simulations, case studies, and decision-making scenarios.

This course emphasizes the development of critical thinking and decision-making skills, fostering a deep understanding of market dynamics and the ability to apply knowledge in real-world contexts. Employees will learn to navigate financial markets confidently, making informed decisions that drive business success. With an editable SCORM format, the course offers continuous development and customization options, ensuring that it aligns with your organization’s evolving needs.

By integrating the course into your corporate training program, you’ll enhance your team’s capabilities in financial decision-making, ultimately impacting your organization’s bottom line. Developed using the CogniSpark AI-powered eLearning authoring tool, this course guarantees an engaging, adaptable, and scalable learning experience that you can embed in any LMS.

Who Is This Course For?

- Finance professionals seeking an Introduction to Financial Markets and Instruments course for career advancement.

- HR managers looking for financial markets training online to include in employee development programs.

- Corporate trainers aiming to enhance their team’s understanding of financial instruments through targeted training for employees.

- Executives interested in scalable financial markets training for better strategic decision-making.

Reasons to Choose Our eLearning Course Catalog

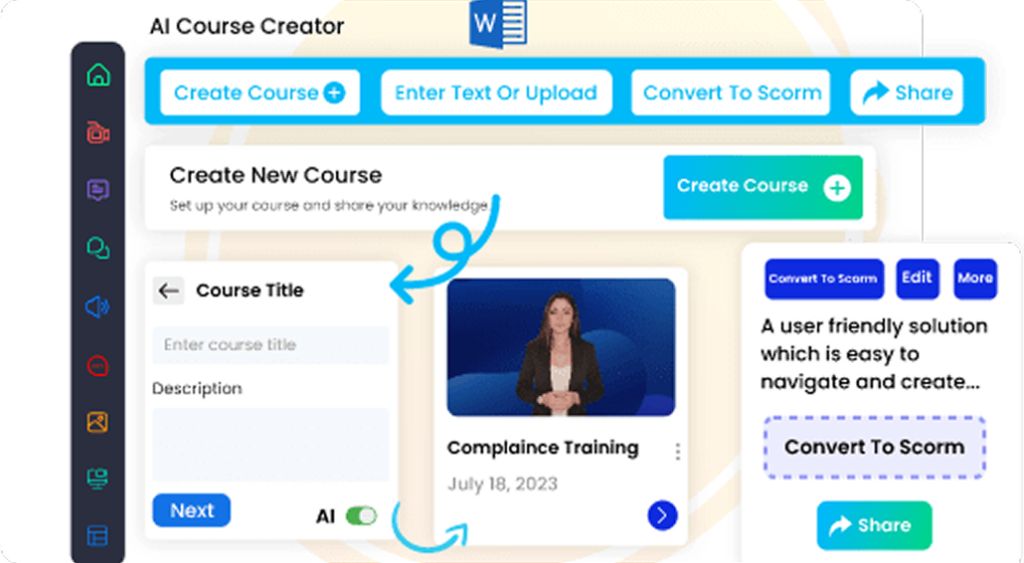

Editable & Embeddable SCORM Course

Easily modify the course content and structure to suit your

needs, then embed it directly into any SCORM-compliant LMS

for seamless deployment and tracking.

Fully Customizable with Built-In Authoring Tools

Adapt course content, visuals, and structure to meet your

specific learning objectives with ease.

White Label eLearning Courses

Seamlessly integrate your branding and deliver a consistent

learning experience across your organization.

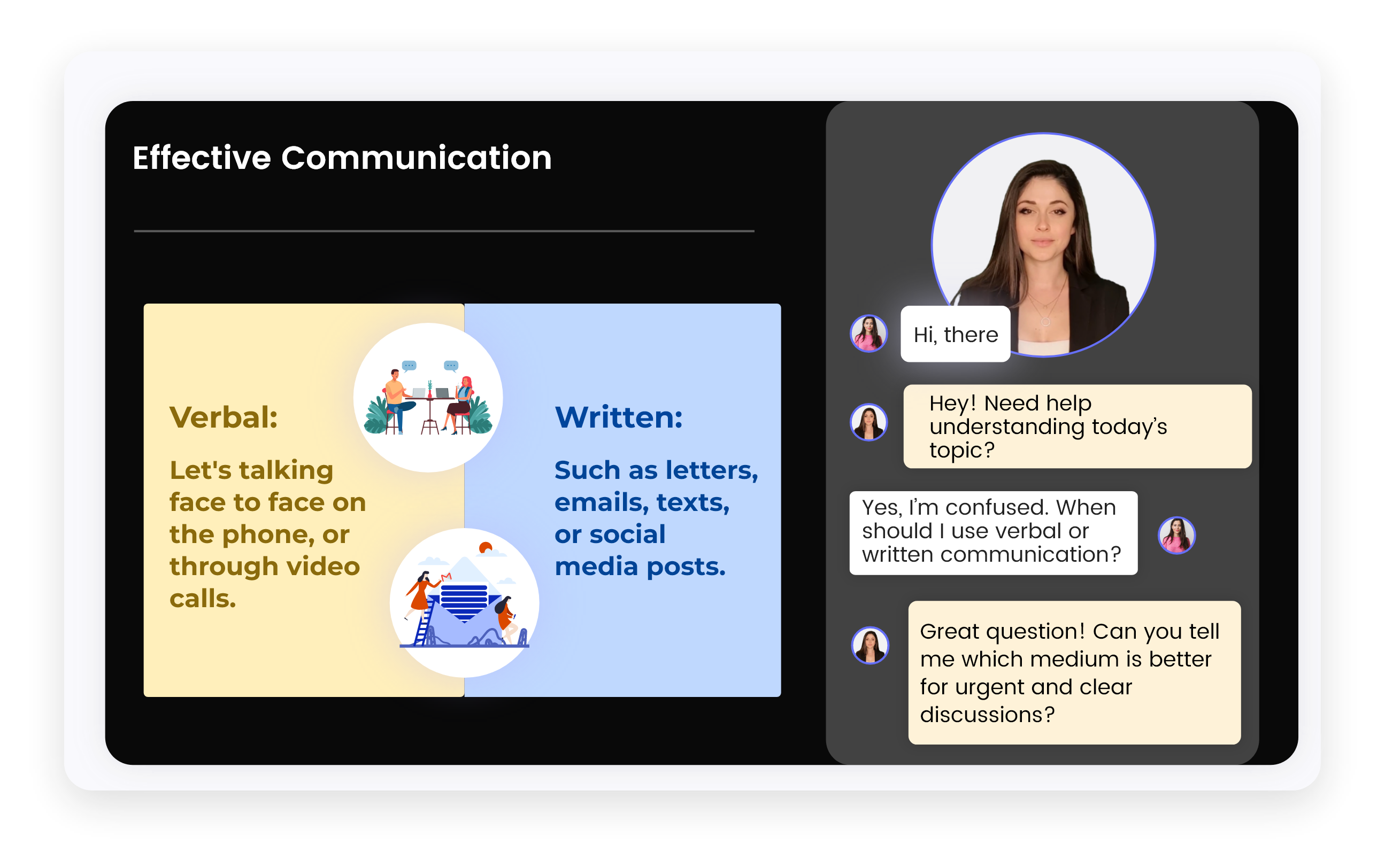

Engaging Content Through Storytelling and Scenarios

Increase retention with real-world communication challenges,

story-driven modules, and practical examples.

Interactive Learning Using Animation and Gamification

Drive learner engagement with visually rich animations, simulations, and game-based learning strategies.

Flexible, Budget-Friendly Pricing Options

Choose a pricing model that fits your organizational needs, whether you’re a startup or a large enterprise.

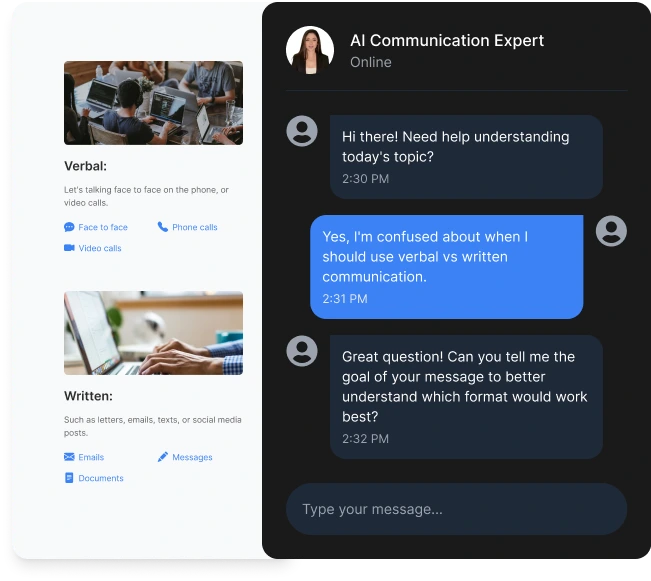

How AI Tutor Helps in eLearning Courses?

Guides learners through the eLearning course

with a personalized, step-by-step learning path.

Explains complex topics in real-time using simple,

easy-to-understand multiple language.

Offers quizzes, helpful hints, and feedback to enhance

understanding and track progress.

Supports voice interaction, allowing learners to speak

instead of type and receive responses in audio format for

a hands-free, engaging experience.

Simulates real-world scenarios through role plays and

interactive simulations to build practical skills and boost

confidence

FAQs (Frequently Asked Questions)

+

The course aims to provide a comprehensive understanding of financial markets and instruments, enabling learners to identify market participants and apply risk management strategies effectively.

+

This course stands out due to its interactive elements, such as simulations and case studies, and its emphasis on real-world applications, making it ideal for corporate training.

+

Learners will gain critical insights into financial markets, enhance decision-making skills, and have the flexibility of a fully editable SCORM course for organizational customization.

+

No prior experience is required, making this course accessible for employees at all levels seeking foundational knowledge in financial markets.

+

Yes, the course is developed on the CogniSpark AI-powered eLearning authoring tool, ensuring it is fully customizable and compatible with your LMS.