What is Insider Trading?

Insider trading involves the buying or selling of securities based on material, non-public information about the company. This kind of trading violates securities laws and can result in fines, penalties, and reputational harm. It’s not just about illegal trades; it also includes actions that give certain individuals an unfair advantage over others in the marketplace.

Insider trading compliance is important because it ensures that employees understand the rules and regulations designed to protect the market from unfair practices. Employees need to recognize when they are crossing the line and what the potential consequences could be for the company.

The Legal Framework Around Insider Trading

Insider trading is governed by a complex legal framework that aims to maintain fairness in financial markets. Understanding these laws is crucial for all employees, particularly in industries dealing with public companies, where the risk of insider trading violations is significant. In this section, we will explore the key laws and regulations that form the foundation of insider trading compliance, so employees can better understand the legal ramifications of their actions.

1. The Securities Exchange Act of 1934

The Securities Exchange Act of 1934 is one of the most important pieces of legislation governing insider trading in the United States. Section 10(b) of this Act, along with Rule 10b-5, prohibits any person from using material, non-public information to make a profit or avoid a loss in the securities market. This Act is the cornerstone of insider trading laws, and any breach of its provisions could lead to severe penalties, including fines and imprisonment.

2. Insider Trading and Securities Fraud Enforcement Act of 1988

Passed by Congress to address the increasing concerns about insider trading, this Act specifically targets illegal trading based on insider information. It allows the Securities and Exchange Commission (SEC) to impose criminal penalties on individuals caught trading on non-public information. It also enables the SEC to seize profits made through insider trading and impose civil penalties on those who engage in it.

3. The Role of the SEC in Enforcing Insider Trading Laws

The Securities and Exchange Commission (SEC) plays a critical role in enforcing insider trading laws. As the regulatory authority for securities markets, the SEC conducts investigations and prosecutes those found in violation of insider trading laws. The SEC’s efforts to curb insider trading have been pivotal in maintaining the integrity of the financial markets, and their investigative powers have been strengthened through various reforms over the years. Their commitment to enforcing these regulations helps ensure that all market participants play by the same set of rules, which is fundamental for maintaining investor confidence.

4. The Importance of Personal Accountability

While much of the focus on insider trading tends to be on corporations and their legal teams, individual accountability is just as important. Employees are expected to take responsibility for their own actions when handling sensitive information. Insider trading training can help employees understand the types of behavior that are considered violations, from tipping off others to using information to make financial gains themselves. By recognizing what constitutes insider trading, employees can avoid making costly mistakes that could not only damage their careers but also lead to significant legal consequences for the company.

Why Employees Need Insider Trading Compliance Training

Insider trading compliance training ensures that employees are aware of the legal and ethical obligations they have when handling confidential information. With proper training, employees can mitigate the risk of unintentional violations and help the company avoid costly legal troubles. Here’s why insider trading compliance training is crucial:

1. Protecting the Company’s Reputation

Any involvement in insider trading scandals can lead to lasting damage to a company’s reputation. Negative media coverage, legal battles, and loss of customer trust can all be consequences of even a single instance of insider trading. Ensuring that employees are well-versed in the company’s compliance training guidelines can help prevent situations that could harm the organization’s public image.

2. Avoiding Legal Consequences

Employees who unknowingly engage in insider trading activities may still face legal action. This could include hefty fines, regulatory penalties, or even criminal charges. Proper insider trading compliance corporate training helps prevent accidental violations by making sure employees understand what constitutes illegal trading behavior.

3. Promoting Ethical Behavior in the Workplace

Insider trading compliance training promotes a culture of integrity and ethics in the workplace. It teaches employees the importance of transparency, honesty, and following the law when handling sensitive information. This training fosters an environment where ethical decision-making is prioritized, leading to more responsible behavior across the organization.

4. Enhancing Organizational Efficiency

When all employees are aware of insider trading policies and procedures, the company can function more smoothly and avoid confusion during crucial decision-making moments. Having clear guidelines allows employees to act decisively within the boundaries of the law, minimizing any potential risk to the company’s operations.

Learning Built Around Your Goals.

Discover how our courses can align with your training goals and drive real results.

How Insider Trading Compliance Training Works

Insider trading compliance training programs typically include a mix of online courses, in-person workshops, and practical scenarios to ensure employees understand both the legal implications of insider trading and how to avoid it. Key elements of these programs often include:

1. Clear Definitions and Case Studies

Training programs often begin with clear definitions of what constitutes insider trading, along with real-life case studies to illustrate the consequences of violating insider trading laws. This helps employees visualize the impact of their actions on the organization.

2. Risk Identification and Management

Employees are trained to identify situations where they may have access to material, non-public information. They are educated on how to handle such information responsibly, ensuring they do not inadvertently breach compliance regulations.

3. Interactive Learning Modules

To enhance understanding and retention, many programs incorporate interactive learning elements such as quizzes, simulations, and role-playing exercises. These modules allow employees to engage with the content and reinforce their knowledge in a practical setting.

4. Continuous Monitoring and Refresher Courses

Insider trading compliance is an ongoing process. Most organizations conduct regular refresher courses and monitor employees’ understanding to ensure that the training remains relevant and effective over time. This helps to reduce the risk of complacency and ensures all employees remain up-to-date with the latest regulations.

Benefits of Insider Trading Compliance Training

Implementing a comprehensive insider trading compliance training program brings several benefits, not only for the employees but also for the organization. Here are the key advantages:

1. Reduced Risk of Non-Compliance

With proper training, employees are less likely to accidentally breach insider trading regulations. This minimizes the risk of costly legal consequences for both individuals and the company.

2. Strengthened Corporate Governance

Regular insider trading compliance training helps foster a culture of compliance and transparency within the organization. This strengthens corporate governance practices, making the company more attractive to investors and partners.

3. Enhanced Employee Awareness

Insider trading training programs raise awareness about the importance of compliance among all employees. This ensures that everyone in the company understands their role in maintaining ethical practices and legal obligations.

4. Increased Investor Confidence

When a company demonstrates its commitment to compliance and ethical behavior through regular training, investors are more likely to have confidence in the organization. This can lead to better financial performance and stronger relationships with stakeholders.

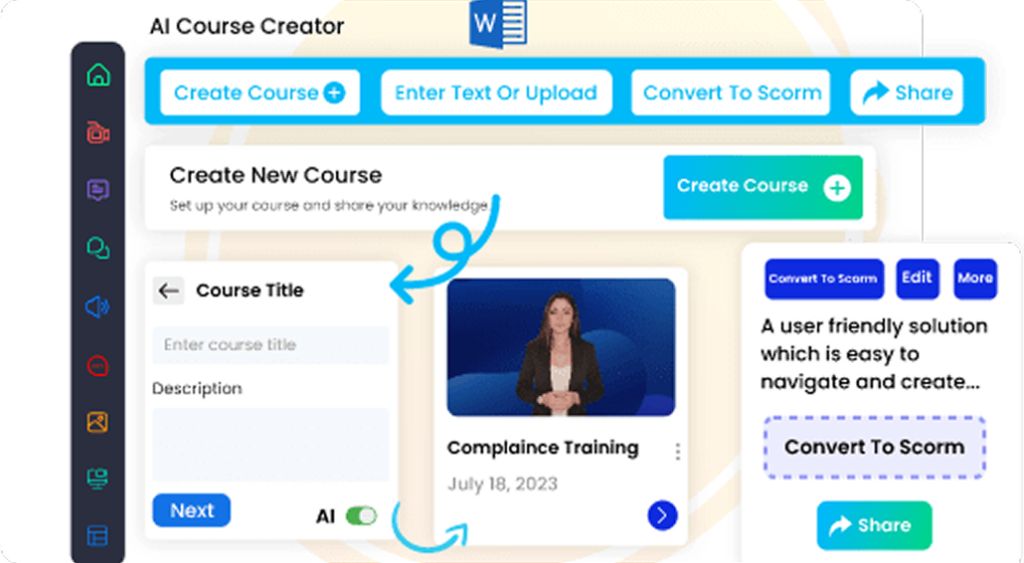

How CogniSpark AI Reinforces Insider Trading Compliance Training for Employees

In highly regulated industries, Insider Trading Compliance Training is essential to protect organizations from legal liabilities and reputational damage. Employees must clearly understand what constitutes insider trading, how to handle material non-public information (MNPI), and the consequences of violations.

CogniSpark AI delivers this critical training through immersive, real-world scenarios that help employees recognize risky behaviors before they escalate. With its AI Tutor, staff can receive real-time feedback while navigating simulated compliance situations—helping them develop sound judgment and reinforce legal awareness.

The platform’s authoring tool makes it easy to update training materials to reflect new regulations, internal policies, or enforcement trends—keeping compliance education current and context-specific.

CogniSpark AI’s LMS compatibility ensures streamlined rollout, tracking, and reporting of completion rates and knowledge retention. Whether for onboarding or annual refresher programs, CogniSpark AI makes insider trading compliance training clear, engaging, and effective—empowering employees to uphold legal and ethical standards with confidence.

Conclusion: Ensuring a Compliant Workforce

Insider trading compliance training is not just a legal necessity but a vital part of maintaining an ethical corporate environment. By educating employees on the risks of insider trading and the importance of compliance, organizations can protect their reputation, avoid costly legal ramifications, and create a culture of transparency and ethical behavior. Given the potential consequences of non-compliance, it is essential that companies invest in robust training programs for all employees, ensuring they understand the importance of insider trading compliance and how to adhere to regulatory requirements. Start empowering your team today with insider trading training, and ensure that your organization remains in good standing with regulators and stakeholders alike.

Access 100+ fully editable, SCORM-compatible courses featuring an integrated AI Tutor and an in-built authoring tool. Seamlessly compatible with any LMS, these courses are designed to elevate your training programs.

Explore Our eLearning Course Catalog

Skip to content

Skip to content