What is Anti-Money Laundering (AML)?

Anti-Money Laundering (AML) refers to the policies, laws, and regulations aimed at preventing money laundering activities, such as hiding illicit gains from illegal activities. Businesses, particularly in the financial sector, must implement these policies to detect and prevent fraud, identity theft, and financial crimes. AML training courses provide employees with the necessary tools to recognize and report suspicious activity, ensuring that they stay compliant with legal frameworks.

Why is AML Training Crucial for Employees?

AML training is not just about meeting regulatory requirements—it’s about protecting the company from financial penalties and reputational damage. Let’s look at the reasons why AML training for employees is a must:

1. Legal Compliance

Regulatory authorities like the Financial Action Task Force (FATF) and the U.S. Department of the Treasury require businesses to have robust anti-money laundering systems in place. Employees who undergo AML training understand the critical aspects of compliance and avoid violations that could lead to hefty fines or loss of business licenses.

2. Detection of Suspicious Activity

AML training teaches employees to spot red flags such as unusual transactions, patterns, or suspicious account activity. Detecting these behaviors early can help mitigate risks and prevent fraud from escalating into a major crisis.

3. Safeguarding Reputation

Failure to comply with AML regulations could severely damage a company’s reputation. AML training ensures that employees uphold the company’s commitment to ethical business practices, which directly impacts customer trust and long-term success.

4. Global Business Operations

In an increasingly globalized world, businesses must comply with international AML standards. AML training courses can help employees understand various global regulatory frameworks and how they impact cross-border transactions.

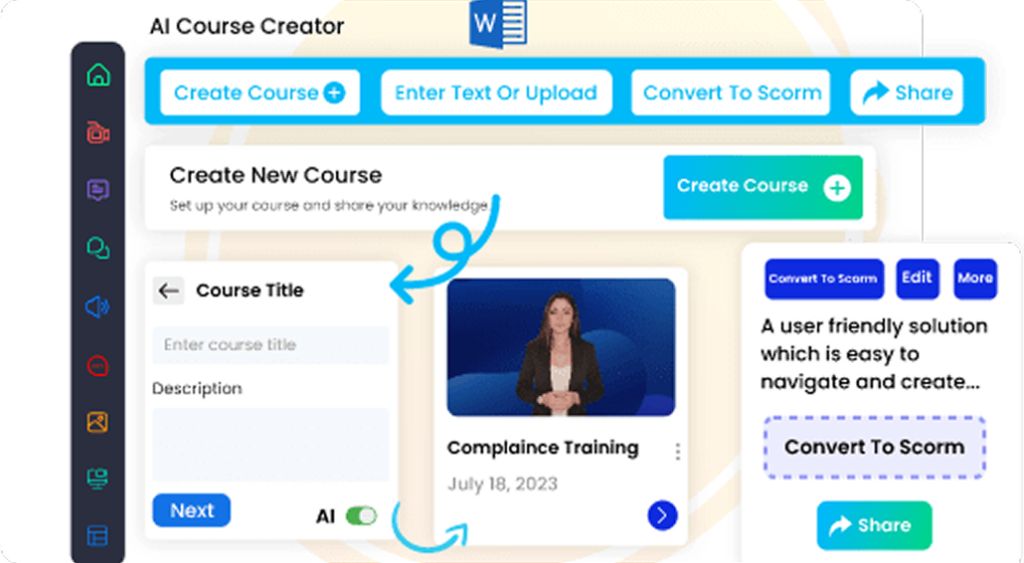

Explore Our eLearning Course Catalog

Access 100+ fully editable, SCORM-compatible courses featuring an integrated AI Tutor and an in-built authoring tool. Seamlessly compatible with any LMS, these courses are designed to elevate your training programs.

Explore Course CatalogKey Components of an Effective AML Training Course

To ensure AML training for employees is comprehensive and effective, it should cover several essential components:

1. Regulatory Frameworks and Requirements

An AML training course should provide a deep dive into local and international AML laws, including the Bank Secrecy Act (BSA) in the U.S., the European Union’s Fourth Anti-Money Laundering Directive, and the FATF recommendations.

2. Identifying Red Flags

Employees must be trained to recognize warning signs such as large, rapid transactions or unusual customer behavior. Training should include real-world case studies to help employees understand how these red flags manifest in daily operations.

3. Reporting Procedures

A crucial aspect of AML training is teaching employees how to report suspicious activity. This includes understanding the internal reporting structure and knowing when to file a Suspicious Activity Report (SAR) with the relevant authorities.

4. Know Your Customer (KYC) and Due Diligence

AML training should also emphasize the importance of KYC processes and due diligence when onboarding new clients. Employees should be trained to verify the identity and financial background of customers to prevent money laundering.

How to Implement AML Training for Employees

Successfully implementing an AML training course requires a structured approach. Here’s a step-by-step guide:

1. Assess the Training Needs

Before rolling out AML training, assess the specific needs of your organization. This includes identifying employees who need training based on their roles, such as compliance officers, customer service reps, and managers.

2. Select an AML Training Course

Choosing the right AML training course is crucial. The course should be comprehensive, easy to understand, and updated regularly to keep pace with evolving regulations. Look for accredited courses that offer certifications upon completion.

3. Incorporate Interactive Elements

To increase engagement, consider adding interactive elements like quizzes, simulations, and case studies to your AML training course. This can help employees retain knowledge and apply it to real-world scenarios.

4. Regularly Update the Training

AML laws and regulations change frequently. Ensure that your training is updated regularly to reflect these changes. Offering refresher courses or periodic updates can help employees stay informed and compliant.

Benefits of AML Training for Employees

AML training provides numerous benefits for both employees and the organization as a whole. Some of the key benefits include:

- Risk Mitigation: By understanding how to detect and report suspicious activity, employees help reduce the company’s exposure to financial crimes.

- Improved Compliance: AML training ensures employees follow the correct procedures to comply with legal and regulatory standards.

- Enhanced Employee Awareness: Employees gain a better understanding of the consequences of money laundering and the importance of ethical business practices.

- Increased Customer Trust: With proper AML procedures in place, customers feel more secure doing business with your organization.

Conclusion

In conclusion, AML training for employees is an essential aspect of regulatory compliance and the fight against financial crimes. By providing a comprehensive AML training course, businesses can protect themselves from legal penalties, enhance employee awareness, and safeguard their reputation. As the landscape of financial regulations continues to evolve, staying up to date with AML training ensures that employees remain equipped to detect and report suspicious activity, helping to keep both the organization and its customers secure.

Smart & Editable Course Catalog

Stop struggling with rigid course listings. Paradiso’s Course Catalog is fully customizable, works with any LMS, and gives you the power to update and manage courses with ease.