Introduction: The Vital Role of Employee Training in KYC and AML Compliance

In the highly regulated financial industry, maintaining effective Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance is crucial to prevent financial crimes, safeguard reputation, and avoid penalties. Central to this effort is comprehensive employee training. Well-trained staff serve as the first line of defense against fraud, money laundering, and illicit activities, equipped with the knowledge and skills needed to detect suspicious behaviors and comply with changing regulations.

AML and KYC training for employees plays a critical role in shaping a compliance-focused workforce. The impact of employee awareness is significant; when staff understand the importance of KYC and AML processes, they are more consistent in policy implementation, vigilant for red flags, and prompt in reporting concerns. Conversely, inadequate training increases errors and oversights, which can lead to legal penalties, reputational damage, and financial loss.

Importantly, regulators emphasize ongoing, adaptive training as threats evolve. Organizations that prioritize AML and KYC training for employees and commit to continuous education demonstrate a proactive compliance culture, fostering integrity and vigilance. Investing in targeted, high-quality training is thus a strategic imperative for protecting the financial system and ensuring operational stability.

Understanding KYC and AML: Definitions and Regulatory Frameworks

To effectively combat financial crimes, organizations must understand the core principles of KYC and AML, along with the laws and standards that govern them. This section explains these concepts and explores the global frameworks shaping compliance practices.

What Is Know Your Customer (KYC)?

Definition and Purpose: KYC involves verifying the identities of clients before engaging in financial transactions. Its primary aim is to prevent identity theft, fraud, and illicit activities by establishing authentic customer identities.

Core Components:

- Customer Identification Program (CIP): Collects personal data like name, date of birth, address, and official ID documents.

- Customer Due Diligence (CDD): Assesses the risk profile by understanding the customer’s activities and source of funds.

- Enhanced Due Diligence (EDD): Applied to high-risk clients or transactions, involving deeper verification and ongoing monitoring.

Importance: Robust KYC procedures reduce financial crime risk, promote transparency, and build trust in financial exchanges.

What Is Anti-Money Laundering (AML)?

Definition and Objectives: AML includes laws and processes to detect, prevent, and report attempts to launder illegally obtained money, thereby protecting the integrity of the financial system.

Key Elements:

- Suspicious Activity Reporting (SAR): Reporting unusual or potentially illicit transactions.

- Customer Risk Assessment: Evaluating clients to determine appropriate monitoring levels.

- Transaction Monitoring: Continuously overseeing transactions for suspicious patterns.

AML measures are vital for combating organized crime, corruption, terrorism, and tax evasion, and for fostering international cooperation.

Global Regulatory Standards

Standards such as the Financial Action Task Force (FATF) Recommendations set international benchmarks. Regional laws like the U.S. Bank Secrecy Act (BSA), EU AML Directives, and national laws in Asia-Pacific align with FATF’s principles, emphasizing due diligence, transparency, and risk-based approaches.

Organizations operating internationally must navigate a complex regulatory landscape, making compliance both challenging and critical. Adherence to these standards ensures consistency, reduces penalties, and helps close gaps exploited by criminals.

Emerging technologies like AI-driven transaction monitoring and digital identity verification are increasingly integrated to meet modern regulations effectively.

Common Challenges in Maintaining KYC and AML Compliance

Ensuring KYC and AML compliance is vital but faces numerous persistent challenges. Recognizing these hurdles enables organizations to develop effective strategies for continuous adherence and risk mitigation. The main obstacles include:

1. Complex and Variable Regulations

Navigating diverse and evolving legal requirements across jurisdictions is difficult. Different regions impose unique documentation, reporting, and verification standards, requiring significant resources to interpret and implement. Misinterpretation or delays can lead to violations, fines, and reputational harm.

2. Evolving Criminal Tactics

Criminals continuously develop sophisticated methods such as digital currencies, layering transactions, and online identity theft to evade detection. Organizations must adopt proactive, adaptive detection tools to combat these tactics; falling behind increases legal and financial risks.

3. Human Errors and Manual Processes

Reliance on manual reviews and human judgment introduces errors, oversight, and inconsistency. Mistakes in customer verification or transaction assessment can lead to missed suspicious activities. Manual procedures also slow down onboarding and monitoring, reducing operational efficiency.

4. Data Management Challenges

Effective compliance depends on integrating vast amounts of data—customer profiles, transactions, watchlists—and keeping it accurate and current. Disconnected systems and data silos hinder comprehensive risk assessment, impair reporting, and increase errors.

5. Resource Limitations and Cost

Many institutions, especially smaller ones, struggle with limited budgets for advanced AML solutions and dedicated compliance teams. Under-resourcing impairs monitoring, reporting, and overall effectiveness, heightening susceptibility to penalties.

6. Building a Consistent Compliance Culture

Achieving organization-wide adherence requires ongoing staff training, leadership commitment, and reinforcement. Turnover, varying risk perception, and complacency threaten policy implementation and enforcement.

The Role of Employee Training in Reducing Compliance Risks

Formal employee training is a vital component of a strong risk management framework. Educated employees can effectively detect suspicious activity, understand legal obligations, and uphold ethical standards, resulting in lower legal, financial, and reputational risks.

Fostering a Culture of Compliance

Well-designed training programs promote a culture where compliance is ingrained in daily routines. Regular sessions, refreshers, and case studies reinforce policies and legal responsibilities, turning compliance into a shared organizational value.

Preventing Illicit Activities

Knowledgeable staff are more likely to recognize red flags like unusual transactions or client behaviors. According to the ACFE, organizations with anti-fraud training experiences 54% fewer fraud incidents, demonstrating training’s preventative power.

Improving Detection and Reporting

Training enhances employees’ ability to identify and escalate suspicious activities swiftly. Clear procedures for filing SARs, escalating issues, and documenting findings ensure timely and effective responses, reducing legal and financial consequences.

Supporting Continuous Education

As threats and regulations evolve, ongoing training—via e-learning, workshops, and updates—is crucial. It keeps staff vigilant, knowledgeable, and prepared for new compliance challenges, boosting overall organizational resilience.

Learning Built Around Your Goals.

Discover how our courses can align with your training goals and drive real results.

Key Components of Effective AML and KYC Training Programs

To develop impactful AML and KYC training, organizations must incorporate essential elements that address current standards and future challenges. Effective programs include:

1. Regulatory and Compliance Updates

Regularly refreshing content with recent regulatory changes prevents outdated practices. Incorporate updates from FATF, relevant authorities, and enforcement action summaries. Reinforcing current requirements ensures staff remain compliant and vigilant.

2. Practical Case Studies and Simulations

Applying theoretical knowledge to real-world scenarios enhances learning retention and decision-making. Case studies of actual AML investigations or fraud schemes, along with simulated exercises, prepare staff for real situations.

3. Technology and Tools Training

Instruction on using modern AML/KYC solutions—transaction monitoring software, AI analytics, digital ID verification—is critical. Familiarity with these tools increases detection accuracy and operational efficiency.

4. Continuous Learning and Skill Reinforcement

Ongoing education through webinars, microlearning, and assessments sustains knowledge levels. Regular updates help staff adapt to new threats and regulatory shifts, strengthening compliance culture.

5. Clear Policies and Reporting Protocols

Training should align with organizational policies, emphasizing procedures for suspicious activity reporting, record-keeping, and escalation. Clear guidance promotes proactive compliance and reduces oversight risks.

Innovative Digital Solutions Enhancing AML and KYC Training

The digital era offers numerous innovative approaches to revolutionize compliance training. These technologies make learning more engaging, effective, and scalable.

Interactive Modules for Engagement

Multimedia-rich modules incorporating videos, quizzes, and gamification increase learner motivation and knowledge retention. Interactive content caters to various learning styles and fosters active participation.

Simulations for Practical Experience

Virtual simulations recreate real-world AML and KYC scenarios, enabling employees to practice identifying suspicious activities in a risk-free setting. Studies show simulation-based training improves application skills by up to 40%.

Digital Assessments and Feedback

Online quizzes and adaptive tests provide immediate feedback, helping employees recognize weaknesses and tailor future learning. Data from assessments guides targeted interventions and curriculum improvements.

The Future of Digital Training

Technologies like Virtual Reality (VR), Augmented Reality (AR), and AI-driven analytics will further personalize and immersive learning experiences. Microlearning and gamification will make continuous compliance education more accessible and engaging.

Embracing these digital solutions ensures organizations stay ahead by providing scalable, interactive, and effective AML/KYC training that meets modern demands.

The Impact of Continuous Training on Compliance Success

Continuous training is essential for organizations to keep pace with changing regulations, emerging threats, and evolving best practices. It fosters a resilient compliance framework capable of proactive risk management.

Why Ongoing Training Matters

Laws and standards are constantly updated—regulatory bodies like FATF, GDPR, and domestic agencies regularly modify requirements. Regular training keeps staff informed, avoiding violations and penalties.

Measuring Effectiveness

Organizations should track metrics such as training completion rates, assessment scores, and post-implementation compliance incidents. Data analysis reveals knowledge gaps and highlights areas needing reinforcement, guiding continuous improvement.

Adapting to New Risks and Regulations

Emerging threats like cyberattacks and new legislation require rapid updates to training content. For example, recent data privacy laws necessitate compliance awareness on data handling and breach reporting.

Sharing Best Practices

Promoting open communication among teams through forums, newsletters, and benchmarking encourages learning from successes and failures, strengthening compliance culture.

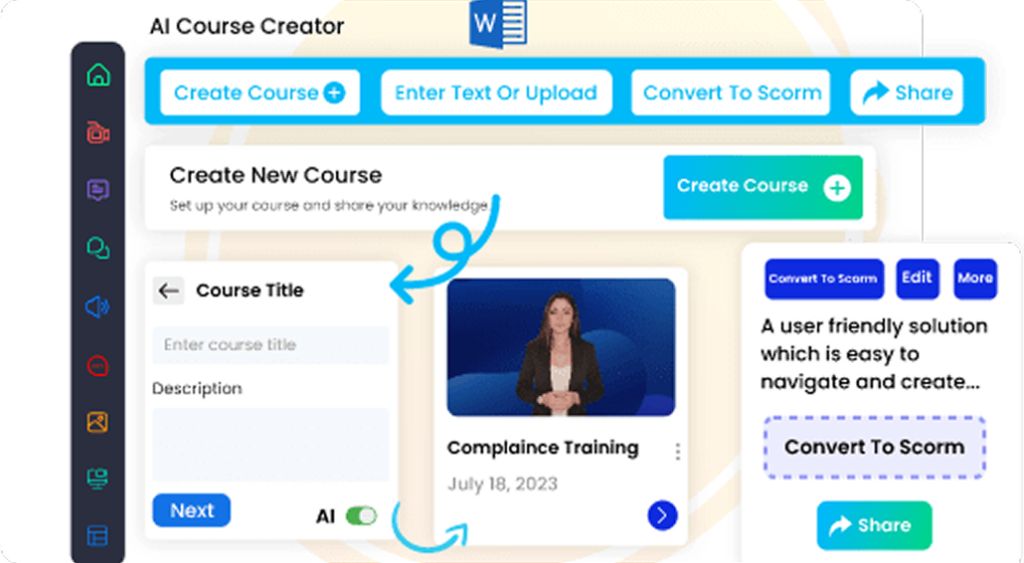

How CogniSpark AI Strengthens KYC and AML Compliance Training

CogniSpark AI brings intelligence and agility to KYC (Know Your Customer) and AML (Anti-Money Laundering) training, helping organizations stay ahead of evolving regulatory requirements. Through AI-driven simulations and real-world scenarios, employees are trained to identify suspicious activities, follow verification protocols, and maintain proper documentation. The integrated AI Tutor offers real-time feedback and guidance, ensuring learners understand the implications of non-compliance and how to mitigate risk effectively.

With CogniSpark’s in-built authoring tool, compliance teams can quickly customize content to reflect the latest regulatory updates, jurisdiction-specific rules, or internal policy changes. The platform is fully LMS-compatible, supporting centralized tracking of training progress, assessment scores, and certification status. Whether training frontline staff or compliance officers, CogniSpark AI ensures your workforce is equipped with the knowledge, judgment, and vigilance needed to protect the organization and uphold global compliance standards.

Learning Built Around Your Goals.

Discover how our courses can align with your training goals and drive real results.

Future Trends: AI and Technology Shaping Employee-Led KYC and AML Compliance

The future of KYC and AML compliance training is being reshaped by cutting-edge technologies like Artificial Intelligence (AI), Machine Learning (ML), and RegTech solutions. These innovations promise more accurate, efficient, and adaptive processes that keep organizations ahead of emerging threats and regulatory changes.

Role of AI & ML

AI and ML are transforming compliance through real-time risk assessment, identity verification, and predictive analytics. They enable:

- Automated Customer Verification: biometric recognition and document analysis streamline onboarding, reducing manual effort and errors.

- Predictive Risk Modeling: analyzing historical data to flag high-risk clients or transactions proactively.

- Continuous Learning: AI systems adapt to new fraud and laundering schemes, enhancing detection over time.

RegTech Integration

RegTech solutions automate compliance tasks like reporting, record-keeping, and regulatory updates. They support:

- Automated Suspicious Activity Reports (SARs) generation

- Monitoring regulatory changes in real-time

- Risk scoring and client profiling

Emerging Training Innovations

Future training will leverage immersive experiences such as Virtual and Augmented Reality (VR/AR), AI-driven personalized modules, and microlearning techniques. These methods make compliance education more engaging and effective, facilitating rapid skill acquisition.

Challenges to Consider

Despite promising advances, organizations must address:

- Data privacy and security concerns

- AI algorithm fairness and bias mitigation

- Regulatory acceptance of automation tools

Conclusion

Improving employee training programs is fundamental for organizational resilience and compliance. To stay ahead:

- Regularly assess training needs to address skill gaps and regulatory changes.

- Implement blended learning combining e-learning, practical exercises, and face-to-face sessions.

- Leverage data analytics to monitor progress and fine-tune content.

- Utilize AI tools like CogniSpark for personalized training, automation, and real-time feedback.

- Promote continuous learning through microlearning modules and ongoing development opportunities.

Cultivating a compliance-driven culture requires leadership commitment, clear policies, and ongoing reinforcement. Regular refresher courses and updated content are necessary to maintain adherence.

Access 100+ fully editable, SCORM-compatible courses featuring an integrated AI Tutor and an in-built authoring tool. Seamlessly compatible with any LMS, these courses are designed to elevate your training programs.

Explore Our eLearning Course Catalog